Whether TP provisions are applicable to the transaction of gift of shares to AE - Held that a company can also gift - Gift of shares held to be exempt u/s 47(iii) - In the absence of income arising in the case of a gift transaction, provisions of Section 92(1) do not apply - Adjustment on account of corporate guarantee given by assessee on behalf of its AE – Held, no addition on account of outstanding corporate guarantee can be made in absence of any impact on profits, income, losses or assets of an enterprise

Redington (India) Ltd vs JCIT (ITA No. 513/Mds/2014)

Background/ Facts

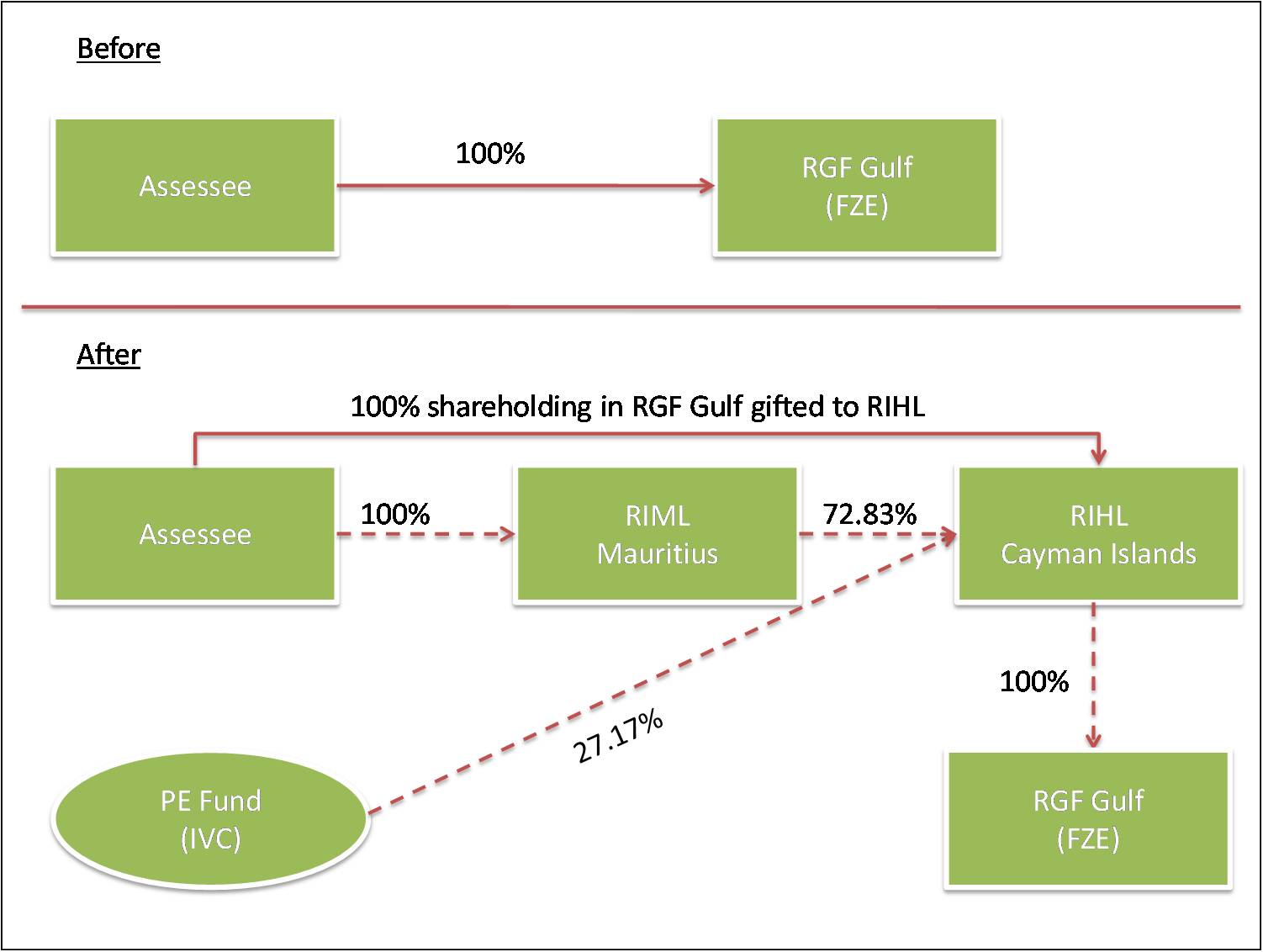

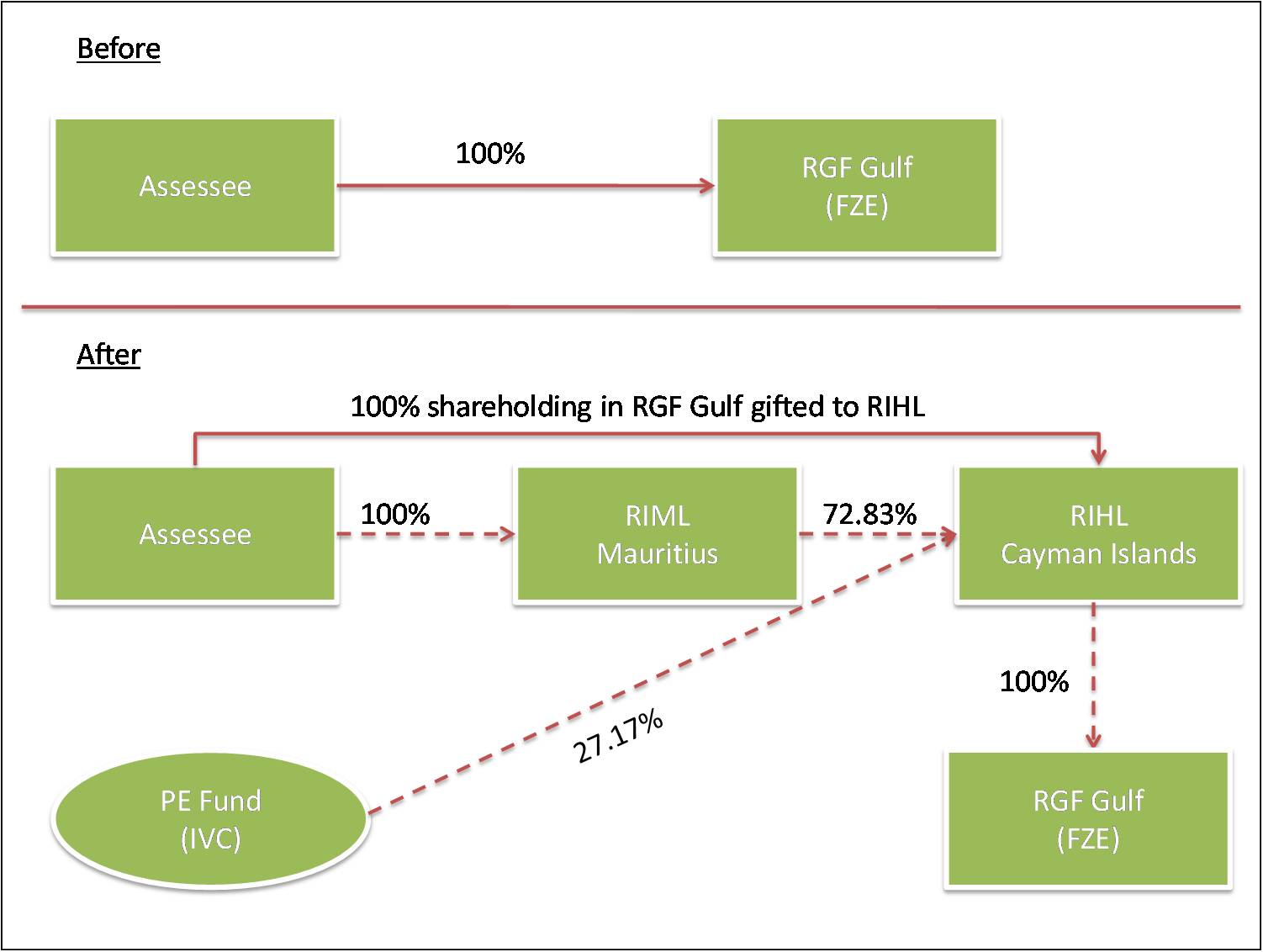

- The Assessee, Redington (India) Ltd., is an Indian company engaged in providing end-to-end supply chain solutions for all categories to IT Industry and had plans to expand its operations in the Middle East and African countries. It has a wholly owned subsidiary viz. RGF Gulf in Dubai, which has set up a Free Zone Enterprise (FZE) in Dubai’s Jabel Ali Free Zone Authority (JAFZA). It also had a plan to list its shares on an overseas stock exchange.

- A Private Equity (PE) fund viz. Investcorp (IVC) expressed its interest to invest in the overseas operations of the Assessee. The funding by the PE fund was also necessary for the Assessee to enable fructification of its plans.

- However, the FZE regulations do not permit more than one shareholder for an enterprise operating under JAFZA and hence, it was not possible for IVC to invest directly into RGF Gulf.

- To overcome this limitation, the Assessee incorporated a wholly owned subsidiary in Mauritius viz. RIML. Further, another wholly owned step down subsidiary was incorporated by RIML in Cayman Islands viz. RIHL Cayman. The Assessee then gifted its shareholding in RGF Gulf to RIHL Cayman in compliance with FZE regulations. IVC subsequently acquired a 27.17% stake in RGF Gulf for a consideration of US$ 65 million.

- The above is explained with the help of a diagram below:

- Separately, the Assessee had outstanding corporate guarantees on behalf of its group companies without any consideration and paid license fees to its Associated Enterprise (AE) for use of “Redington” trademark.

Key issues before the Tribunal

- Whether Transfer Pricing (TP) provisions were applicable to the transaction of gift of shares by the Assessee to RIHL Cayman given the provisions of section 47(iii) of the Act, whereby no income arises to the Assessee.

- Whether TP adjustment was warranted on account of issuance of corporate guarantee on behalf of AE without any consideration.

- Whether TP adjustment was warranted on account of payment of license fees to AE.

Key observations and decision of the Tribunal

The Tribunal held in favour of the Assessee on all the three issues. Its key observations are as under:

- The contention of the department that a company cannot make a gift, and hence exemption u/s 47(iii) is not available to companies is incorrect, as the mother law governing transfer of property is Transfer of Property Act, 1882, as per which a company is included in the definition of a ‘person’ and hence can make a gift.

Further, in case of a transaction of a gift, no income arises or accrues and hence, provisions of Section 92(1) of the Income-tax Act (the Act), which deal with computation of ALP in respect of “income” arising from an international transaction, shall not apply.

- Further, the Tribunal, relying upon the decision of the Hon’ble Supreme Court in the case of B.C. Srinivasa Shetty [128 ITR 294], agreed with the contention of the Assessee, that, in any case, where there is no consideration involved in a transfer, computation provisions contained in Section 48 fail and thus, the charge under Section 45 fails.

- On the TP adjustment pertaining to corporate guarantee, the Tribunal relying upon the decision of the Delhi Tribunal in the case of Bharti Airtel Ltd. [43 Taxmann.com 150], reiterated that where there is no cost attached to the provision of corporate guarantee, the same cannot be held to be an ‘international transaction’, even under the definition of the said term as amended by the Finance Act, 2012. This is because the guarantee provided by an assessee does not have any bearing on profits, income, losses or assets of the assessee.

- Further, as regards the TP adjustment on account of payment of license fees made by the TPO, the Tribunal observed that use of trademarks and consequent payments in respect of the same is a normal business practice; there was no need for the TPO to step into the shoes of the Assessee for determining the commercial expediency of a transaction. The Tribunal relied upon the Hon’ble Supreme Court decision in the case of S.A. Builders vs. CIT [288 ITR 01] in this regard.

Our Comments:

This ruling reinforces the proposition that the provisions of Section 92 dealing with the arm’s length evaluation of income arising from an international transaction come into play only if such income is taxable under the provisions of the Act. Thus, if there is no income or the income could not be brought to charge under the Act, then Section 92 would not come into play.

The Tribunal has followed Bharti Airtel’s decision as regards corporate guarantee not being an international transaction u/s 92B of the Act. However, probably, even in case of corporate guarantee one would need to see how the law evolves as regards the applicability of Section 92(1) of the Act.